Another purpose Madoff managed to fly under the radar for therefore lengthy (despite multiple studies to the SEC about suspicions of a Ponzi scheme) is as a result of Madoff was a properly-versed and energetic member of the monetary business. It was easy to believe the industry veteran knew precisely what he was doing. COCONUT CREEK, Fla. - Santiago Ponzinibbio is itching for gold, and he’s doing all the things in his energy to scratch that itch. An extremely exciting matchup has been scheduled for UFC Fight Night 206, as Santiago Ponzinibbio faces off with Brazilian fan favourite Michel Pereira. A welterweight showdown between Santiago Ponzinibbio and Michel Pereira is agreed for the upcoming UFC Fight Night card on May 21, a number of individuals with information of the booking confirmed the information to MMA Fighting following a report from The Underground. The 35-yr-previous will struggle at 170 lbs and comes in at 6'0". The 35-yr-old will fight at 170 lbs. Is available in at 6'0". The orthodox fighter reaches 73". Michel "Demolidor" Pereira stands in at 6'1" and will battle at 170 lbs. Will you pick up. The bureau didn't specify a trigger of dying, saying in a statement that it is going to be decided by a medical examiner.

Another purpose Madoff managed to fly under the radar for therefore lengthy (despite multiple studies to the SEC about suspicions of a Ponzi scheme) is as a result of Madoff was a properly-versed and energetic member of the monetary business. It was easy to believe the industry veteran knew precisely what he was doing. COCONUT CREEK, Fla. - Santiago Ponzinibbio is itching for gold, and he’s doing all the things in his energy to scratch that itch. An extremely exciting matchup has been scheduled for UFC Fight Night 206, as Santiago Ponzinibbio faces off with Brazilian fan favourite Michel Pereira. A welterweight showdown between Santiago Ponzinibbio and Michel Pereira is agreed for the upcoming UFC Fight Night card on May 21, a number of individuals with information of the booking confirmed the information to MMA Fighting following a report from The Underground. The 35-yr-previous will struggle at 170 lbs and comes in at 6'0". The 35-yr-old will fight at 170 lbs. Is available in at 6'0". The orthodox fighter reaches 73". Michel "Demolidor" Pereira stands in at 6'1" and will battle at 170 lbs. Will you pick up. The bureau didn't specify a trigger of dying, saying in a statement that it is going to be decided by a medical examiner.

Forcing Pereira to trade benefits Ponzinibbio and i imagine that his footwork will both power Pereira to stay on his bike and expel energy and make it harder for Periera to time his bursts forward. Pereira is one of the crucial spectacular fighters within the UFC. Ponzinibbio was undeterred as he continued to return after Neal along with his combinations whereas looking for to seek out a house for considered one of his power punches. As time moved ahead deep into the second round, Ponzinibbio’s output continued to increase whereas Neal was slowing down, which saved the combat close on the scorecards. “They told me I might not be able to battle once more in my life,” he stated. UFC PI told me, ‘This just isn't regular at all.’ I was nonetheless utilizing very sturdy anti-inflammatory. Verbal agreements are in place for Ponzinibbio (28-5 MMA, 10-four UFC) to compete in his first struggle of 2022 towards Pereira (27-eleven MMA, 5-2 UFC) on May 21. MMA Junkie confirmed the news of the matchup following an initial report from The Underground. I’d wish to be back as quickly as doable, they stated ‘we have this child in June, no one wish to fight this kid,’ I said give me.

Forcing Pereira to trade benefits Ponzinibbio and i imagine that his footwork will both power Pereira to stay on his bike and expel energy and make it harder for Periera to time his bursts forward. Pereira is one of the crucial spectacular fighters within the UFC. Ponzinibbio was undeterred as he continued to return after Neal along with his combinations whereas looking for to seek out a house for considered one of his power punches. As time moved ahead deep into the second round, Ponzinibbio’s output continued to increase whereas Neal was slowing down, which saved the combat close on the scorecards. “They told me I might not be able to battle once more in my life,” he stated. UFC PI told me, ‘This just isn't regular at all.’ I was nonetheless utilizing very sturdy anti-inflammatory. Verbal agreements are in place for Ponzinibbio (28-5 MMA, 10-four UFC) to compete in his first struggle of 2022 towards Pereira (27-eleven MMA, 5-2 UFC) on May 21. MMA Junkie confirmed the news of the matchup following an initial report from The Underground. I’d wish to be back as quickly as doable, they stated ‘we have this child in June, no one wish to fight this kid,’ I said give me.

That is like to show tonight. I do know Geoff is a tough fight. It seemingly helped him sway the judges in his favor as he acquired again on track following a tough run in his last two fights. But at the same time, there wasn’t a single athlete that outclassed me where you go, ‘Look, this guy is simply at one other degree.’ No. “With Li I acquired caught in the proper spot. Ponzinibbio’s body reworked from the athlete who had turn into one of the feared strikers on the complete UFC roster to a frail civilian. The 82-year-outdated, who's believed to have died from pure causes, carried out one in all the largest fraudulent schemes in US historical past before he landed in prison. He was restricted to just one appearance in 2020 as a consequence of health causes. That mentioned, Ponzinibbio admits he was “bothered” by how the UFC dealt with his scenario when he was forced to remain on the sidelines between 2018 and 2021 while battling severe accidents and health issues. While Neal was still connecting together with his finest pictures each time Ponzinibbio was shifting ahead, he was additionally cautious not to go away himself overextended throughout the exchanges. I’m not ready to call photographs.

I’m not taking a look at his game, I’ll go out and do my job, which is to beat people up, throw heavy hands and knock him out. Bernie Madoff, the Wall Street con artist who masterminded the most important Ponzi scheme in historical past and bilked thousands of investors out of billions of dollars, has died in prison. In 2008, he was convicted of conspiracy and cash laundering expenses and sentenced to 25 years in federal prison. In 2009, Madoff was sentenced to 150 years in prison for working a pyramid scheme so all-encompassing that even at this time, only some of his victims have regained all of their losses. Madoff actually solely made off with $20 billion, though on paper he cheated clients out of $65 billion, in keeping with CNNMoney. Fighting out of Argentina, Ponzinibbio returned in 2021 from a 26-month layoff. Once he finally obtained the proper prognosis, the previous Ultimate Fighter: Brazil contender returned to the gym. The UFC has but to reveal the situation for the card, which options former champion Holly Holm taking on Ketlen Vieira in the primary event. 12/11/2021 UFC 269: Oliveira vs.

Ponzi would then change the IRC for stamps worth more than he paid for them, and promote the stamps. Critically, these purchases weren't made with dollars, however with Tether, one other kind of cryptocurrency generally known as a “stablecoin” as a result of its worth is pegged to the dollar so that one tether is at all times value one dollar. By comparison, personal corporations issuing stablecoins are indiscriminately inflating cryptocurrency costs so that they are often dumped on unsuspecting traders. A Ponzi scheme promises manner more than a market can naturally supply or accomplish. Is crypto the answer to the backlashes of the standard systems, or a more advanced model of a Ponzi Scheme? International tax officials have identified greater than 50 leads to potential crypto tax crimes which will lead to official investigations in the coming weeks, including one case that may very well be a $1 billion Ponzi scheme. He suffered and managed to survive investor runs, till ultimately the scheme collapsed lower than a 12 months into it. In each deal, Horwitz would difficulty a be aware to the investor promising repayment in six months or a yr with a generous return. David Harrold and Bruce Prevost - SEC charged two Florida-based mostly hedge fund managers and their companies with fraudulently funneling greater than a billion dollars of investor money into a Ponzi scheme operated by Minnesota businessman Thomas Petters.

Ponzi would then change the IRC for stamps worth more than he paid for them, and promote the stamps. Critically, these purchases weren't made with dollars, however with Tether, one other kind of cryptocurrency generally known as a “stablecoin” as a result of its worth is pegged to the dollar so that one tether is at all times value one dollar. By comparison, personal corporations issuing stablecoins are indiscriminately inflating cryptocurrency costs so that they are often dumped on unsuspecting traders. A Ponzi scheme promises manner more than a market can naturally supply or accomplish. Is crypto the answer to the backlashes of the standard systems, or a more advanced model of a Ponzi Scheme? International tax officials have identified greater than 50 leads to potential crypto tax crimes which will lead to official investigations in the coming weeks, including one case that may very well be a $1 billion Ponzi scheme. He suffered and managed to survive investor runs, till ultimately the scheme collapsed lower than a 12 months into it. In each deal, Horwitz would difficulty a be aware to the investor promising repayment in six months or a yr with a generous return. David Harrold and Bruce Prevost - SEC charged two Florida-based mostly hedge fund managers and their companies with fraudulently funneling greater than a billion dollars of investor money into a Ponzi scheme operated by Minnesota businessman Thomas Petters. Because the launch of a current US Bitcoin change-traded fund (ETF), Bitcoin has started to look like a Ponzi scheme for a lot of outsiders. Recent evaluation reveals that round $25 billion and rising has already gone to Bitcoin miners, who, by finest estimates, at the moment are spending $1 billion simply on electricity every month, probably more. That’s billion with a 'B' and this lead additionally touches every single J5 country,” Lee stated. 1 billion Ponzi scheme. Edwin Fujinaga - SEC charged the proprietor of a Las Vegas-based agency with perpetrating a Ponzi scheme towards thousands of traders residing primarily in Japan. SEC later introduced that $230 million held in an offshore account by a fund affiliated with the investment adviser has been returned to the U.S. Every investment carries a point of risk, and investments yielding greater returns usually contain extra threat. It was nonetheless enough for Neal to get the victory as he returns to the win column after suffering again-to-back losses in his previous two outings in the octagon. They allege Gilbert J. Peter Jr.’s wealth is all a facade and that he finances his opulent lifestyle on the backs of investors, including two million-greenback properties in Parkland and Pompano Beach and non-public college tuition at North Broward Prep for his kids, all while promising high returns on investments.

Because the launch of a current US Bitcoin change-traded fund (ETF), Bitcoin has started to look like a Ponzi scheme for a lot of outsiders. Recent evaluation reveals that round $25 billion and rising has already gone to Bitcoin miners, who, by finest estimates, at the moment are spending $1 billion simply on electricity every month, probably more. That’s billion with a 'B' and this lead additionally touches every single J5 country,” Lee stated. 1 billion Ponzi scheme. Edwin Fujinaga - SEC charged the proprietor of a Las Vegas-based agency with perpetrating a Ponzi scheme towards thousands of traders residing primarily in Japan. SEC later introduced that $230 million held in an offshore account by a fund affiliated with the investment adviser has been returned to the U.S. Every investment carries a point of risk, and investments yielding greater returns usually contain extra threat. It was nonetheless enough for Neal to get the victory as he returns to the win column after suffering again-to-back losses in his previous two outings in the octagon. They allege Gilbert J. Peter Jr.’s wealth is all a facade and that he finances his opulent lifestyle on the backs of investors, including two million-greenback properties in Parkland and Pompano Beach and non-public college tuition at North Broward Prep for his kids, all while promising high returns on investments. Ponzi schemes are engaging as a result of they promise returns that are too good to be true, while making buyers feel like they've been let in on a secret trick for making easy cash. But with a Ponzi scheme, funds can be recovered and returned to buyers. Mike Novogratz, CEO of Galaxy Investment Partners, infamously likened Bitcoin to a pyramid scheme, regardless of how his company’s primary operate is cryptocurrency investments. A bunch of scammers working out of China below the identify PlusToken had attracted around US$2bn worth of cryptocurrency investments, in line with a report released by blockchain analyst group Chainalysis, with US$185mln of that sum having already been liquidated. A 'Ponzi scheme' is a scheme in which investors are promised extraordinary returns, however meanwhile these returns are simply paid out from the inflow off new funds from new investors within the scheme. They bought homes and condominium buildings on the south facet of Chicago, renovated them and provided investors month-to-month income from the rental proceeds. In a scene from the now-traditional movie The big Short, fictional hedge fund manager Mark Baum and his crew interviewed a few dubious agents, who jokingly divulged they have been leaving “the earnings part blank” to underwrite a higher number of mortgages.

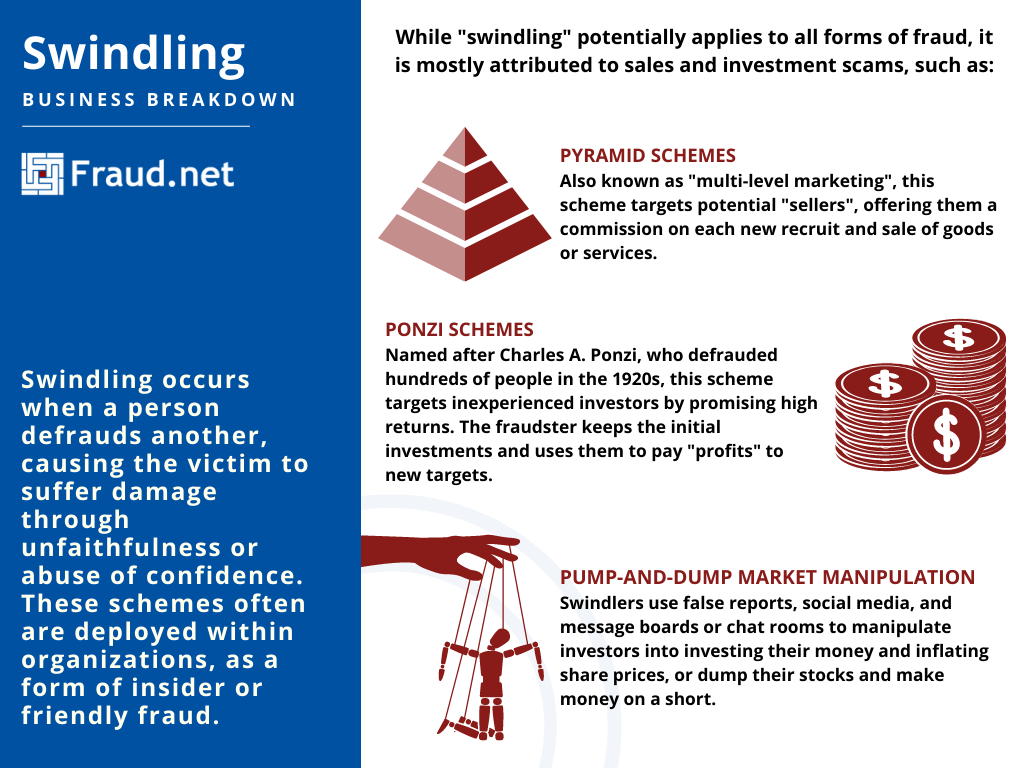

Ponzi schemes are engaging as a result of they promise returns that are too good to be true, while making buyers feel like they've been let in on a secret trick for making easy cash. But with a Ponzi scheme, funds can be recovered and returned to buyers. Mike Novogratz, CEO of Galaxy Investment Partners, infamously likened Bitcoin to a pyramid scheme, regardless of how his company’s primary operate is cryptocurrency investments. A bunch of scammers working out of China below the identify PlusToken had attracted around US$2bn worth of cryptocurrency investments, in line with a report released by blockchain analyst group Chainalysis, with US$185mln of that sum having already been liquidated. A 'Ponzi scheme' is a scheme in which investors are promised extraordinary returns, however meanwhile these returns are simply paid out from the inflow off new funds from new investors within the scheme. They bought homes and condominium buildings on the south facet of Chicago, renovated them and provided investors month-to-month income from the rental proceeds. In a scene from the now-traditional movie The big Short, fictional hedge fund manager Mark Baum and his crew interviewed a few dubious agents, who jokingly divulged they have been leaving “the earnings part blank” to underwrite a higher number of mortgages.

The Ponzi scheme generates returns for older traders by acquiring new traders. Some cryptocurrency fraudsters enchantment to people’s greed, promising large returns. Usually generate returns between few hours to over a protracted time period. Azim and Azam offer a compelling perspective on what enabled the expansion and growth of Madoff’s Ponzi scheme nearly a century after it was tried for the primary time and resulted in failure and criminal prices (125). According to Azim and Azam, the case of Bernie Madoff may be analyzed by using the fraud triangle: a concept that's used for understanding how fraudulent crimes are dedicated. The popularity of Internet-mediated financial establishments and transactions has in turn yielded the expansion of fraudulent monetary investments, resembling Ponzi and pyramid schemes. These schemes that parade as different monetary institutions, persuade investors using totally different approaches. BitConnect was charged by two US prosecutors of operating "a textbook" Ponzi scheme by paying earlier investors with money from later buyers. The financial institution failed and the owner ran off to Mexico with the rest of the money.

The Ponzi scheme generates returns for older traders by acquiring new traders. Some cryptocurrency fraudsters enchantment to people’s greed, promising large returns. Usually generate returns between few hours to over a protracted time period. Azim and Azam offer a compelling perspective on what enabled the expansion and growth of Madoff’s Ponzi scheme nearly a century after it was tried for the primary time and resulted in failure and criminal prices (125). According to Azim and Azam, the case of Bernie Madoff may be analyzed by using the fraud triangle: a concept that's used for understanding how fraudulent crimes are dedicated. The popularity of Internet-mediated financial establishments and transactions has in turn yielded the expansion of fraudulent monetary investments, resembling Ponzi and pyramid schemes. These schemes that parade as different monetary institutions, persuade investors using totally different approaches. BitConnect was charged by two US prosecutors of operating "a textbook" Ponzi scheme by paying earlier investors with money from later buyers. The financial institution failed and the owner ran off to Mexico with the rest of the money.

With that $1,000 pocketed, this individual should find another batch of buyers to pay a minimum of $1,000 mixed in an effort to pay back the initial investors and hopefully make a revenue. Jason Bo-Alan Beckman - SEC obtained an emergency asset freeze against a Minnesota resident and his investment advisory firm in a Ponzi scheme that raised not less than $194 million from almost 1,000 traders in fraudulent choices associated to overseas foreign money trading. McGinn, Smith & Co. - SEC charged two individuals and their broker-seller and funding adviser entities with fraudulently elevating greater than $136 million from approximately 900 investors in greater than 20 unregistered debt choices in which investor funds have been diverted for unauthorized purposes. George Levin and Frank Preve - SEC charged two individuals who provided the largest inflow of investor funds into one among the most important-ever Ponzi schemes in South Florida. Five actual estate executives - SEC charged 5 former executives at Cay Clubs Resorts and Marinas with defrauding buyers into believing they have been funding the event of 5-star vacation spot resorts in Florida and Las Vegas once they had been really shopping for right into a $300 million Ponzi scheme. Jenny E. Coplan - SEC charged a lady living in South Florida with defrauding investors in a Ponzi scheme and affinity fraud that focused the native Colombian-American group and concerned purported investments in immigration bail bonds.

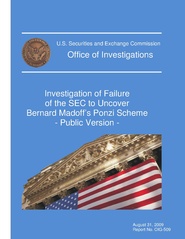

With that $1,000 pocketed, this individual should find another batch of buyers to pay a minimum of $1,000 mixed in an effort to pay back the initial investors and hopefully make a revenue. Jason Bo-Alan Beckman - SEC obtained an emergency asset freeze against a Minnesota resident and his investment advisory firm in a Ponzi scheme that raised not less than $194 million from almost 1,000 traders in fraudulent choices associated to overseas foreign money trading. McGinn, Smith & Co. - SEC charged two individuals and their broker-seller and funding adviser entities with fraudulently elevating greater than $136 million from approximately 900 investors in greater than 20 unregistered debt choices in which investor funds have been diverted for unauthorized purposes. George Levin and Frank Preve - SEC charged two individuals who provided the largest inflow of investor funds into one among the most important-ever Ponzi schemes in South Florida. Five actual estate executives - SEC charged 5 former executives at Cay Clubs Resorts and Marinas with defrauding buyers into believing they have been funding the event of 5-star vacation spot resorts in Florida and Las Vegas once they had been really shopping for right into a $300 million Ponzi scheme. Jenny E. Coplan - SEC charged a lady living in South Florida with defrauding investors in a Ponzi scheme and affinity fraud that focused the native Colombian-American group and concerned purported investments in immigration bail bonds. The Bernard Madoff Ponzi scheme was declared as the biggest Ponzi scheme in historical past. To begin with, HSBC appeared to be among the largest victims of Bernard Madoff Ponzi scheme. The so referred to as largest fraud nevertheless has left big monetary results on the buyers out there. However, this scam has left not just victims but in addition massive after results. Also the very fact the wife’s entire household was within the business for many years was sufficient to make them believe that their funding in Madoff’s scam was a manner ahead. Make them think that every one that he was providing them was a legit deal. One of many methods the schemes earn a living is by promising giant and consistent returns. The new York Mets owners Wilpon and Katz involvement in the Madoff’s Ponzi is alleged to have an effect on the Mets’ report in numerous methods. Many specialists found the inaction of the SEC to be a significant component within the longevity of Madoff’s Ponzi scheme. He has stopped attending the SEC hearings in Chicago. Doris E. Nelson - SEC charged the proprietor of a Spokane, Wash.-primarily based payday loan enterprise with conducting an enormous Ponzi scheme that raised roughly $135 million from lots of of investors.

The Bernard Madoff Ponzi scheme was declared as the biggest Ponzi scheme in historical past. To begin with, HSBC appeared to be among the largest victims of Bernard Madoff Ponzi scheme. The so referred to as largest fraud nevertheless has left big monetary results on the buyers out there. However, this scam has left not just victims but in addition massive after results. Also the very fact the wife’s entire household was within the business for many years was sufficient to make them believe that their funding in Madoff’s scam was a manner ahead. Make them think that every one that he was providing them was a legit deal. One of many methods the schemes earn a living is by promising giant and consistent returns. The new York Mets owners Wilpon and Katz involvement in the Madoff’s Ponzi is alleged to have an effect on the Mets’ report in numerous methods. Many specialists found the inaction of the SEC to be a significant component within the longevity of Madoff’s Ponzi scheme. He has stopped attending the SEC hearings in Chicago. Doris E. Nelson - SEC charged the proprietor of a Spokane, Wash.-primarily based payday loan enterprise with conducting an enormous Ponzi scheme that raised roughly $135 million from lots of of investors. Clients are promised excessive income with little or no threat after they engage in a Ponzi scheme, which is funding fraud. When these investors noticed the promised earnings, phrase unfold quick and the number of investors grew rapidly, changing into the source of money to pay the faux earnings owed to earlier buyers. One monetary author identified that it was unattainable for Charles Ponzi to make the money wanted to pay the promised quantities to all of his traders using reply coupon arbitrage. The US Postal service reported that there weren’t sufficient coupons in circulation to cover the amount of cash being paid to the sooner buyers and there was no signal of any large and rising arbitrage in the coupons. During the best Depression, Ponzi realized he could not have a whole lot of tens of millions of sick-gotten money. The price of crypto's finest-recognized coin, bitcoin, has slumped since November and currencies that have been touted as secure and secure as a result of they were pegged to the dollar and monitored through exchanges have seen their valuations crumble. From the lack of precise effort in doing greater than small test exchanges of worldwide reply coupons, it appears that Charles was already pondering of utilizing new investor cash to repay previous traders when he introduced in his first buyers.

Clients are promised excessive income with little or no threat after they engage in a Ponzi scheme, which is funding fraud. When these investors noticed the promised earnings, phrase unfold quick and the number of investors grew rapidly, changing into the source of money to pay the faux earnings owed to earlier buyers. One monetary author identified that it was unattainable for Charles Ponzi to make the money wanted to pay the promised quantities to all of his traders using reply coupon arbitrage. The US Postal service reported that there weren’t sufficient coupons in circulation to cover the amount of cash being paid to the sooner buyers and there was no signal of any large and rising arbitrage in the coupons. During the best Depression, Ponzi realized he could not have a whole lot of tens of millions of sick-gotten money. The price of crypto's finest-recognized coin, bitcoin, has slumped since November and currencies that have been touted as secure and secure as a result of they were pegged to the dollar and monitored through exchanges have seen their valuations crumble. From the lack of precise effort in doing greater than small test exchanges of worldwide reply coupons, it appears that Charles was already pondering of utilizing new investor cash to repay previous traders when he introduced in his first buyers. There would have been no rational purpose to pay any investor a return of 50% in 45 days. “If Bernie reported that Andrew mentioned I used to be a good man, it should have come by means of Ruth,” stated Campbell. If it sounds too good to be true, it probably is simply too good to be true. Charles Ponzi hired a publicist, which appeared like a very good concept at the time. It’s too dangerous some individuals just can’t control themselves when introduced with the concept of a magical money machine, even years after it’s been audited and proven in court to be nothing more than a pathetic fraud. Identified that Charles Ponzi wasn’t even investing in his own scheme. Things spiraled out of control shortly. The same newspaper operating the sequence of articles concerning the fraud paid the publicist to put in writing an article, which confirmed Charles was about $four million dollars wanting what he wanted if all buyers decided to money out. Another newspaper ran articles in July of 1920 exhibiting that what the corporate claimed was not possible. Back then, the regulation positioned a a lot higher share of the burden of proof on the author and writer, with no approach for any demand of audited data from Charles Ponzi’s company.

There would have been no rational purpose to pay any investor a return of 50% in 45 days. “If Bernie reported that Andrew mentioned I used to be a good man, it should have come by means of Ruth,” stated Campbell. If it sounds too good to be true, it probably is simply too good to be true. Charles Ponzi hired a publicist, which appeared like a very good concept at the time. It’s too dangerous some individuals just can’t control themselves when introduced with the concept of a magical money machine, even years after it’s been audited and proven in court to be nothing more than a pathetic fraud. Identified that Charles Ponzi wasn’t even investing in his own scheme. Things spiraled out of control shortly. The same newspaper operating the sequence of articles concerning the fraud paid the publicist to put in writing an article, which confirmed Charles was about $four million dollars wanting what he wanted if all buyers decided to money out. Another newspaper ran articles in July of 1920 exhibiting that what the corporate claimed was not possible. Back then, the regulation positioned a a lot higher share of the burden of proof on the author and writer, with no approach for any demand of audited data from Charles Ponzi’s company. Charles Ponzi employed a publicist, which seemed like a very good idea at the time. Good also told the shoppers that these investments had been “low-risk” and would pay returns of between 6% and 10% over three-month or six-month phrases,” in line with the SEC. Madoff’s financial swindle began to fall apart as his purchasers took cash out sooner than he may bring in recent cash. These current purchasers often will even reinvest their very own funds back into the funding opportunity (scheme) on account of their excitement and joy of receiving such high returns on a constant foundation. New investors are drawn in as a result of this early success, and their funds are utilized to repay the unique investors, so perpetuating the cycle. Issues with paperwork. Account statement errors could also be a sign that funds should not being invested as promised. This is true arbitrage - having a market to purchase one thing for lower than you might be sure to be able to sell it for on another market.

Charles Ponzi employed a publicist, which seemed like a very good idea at the time. Good also told the shoppers that these investments had been “low-risk” and would pay returns of between 6% and 10% over three-month or six-month phrases,” in line with the SEC. Madoff’s financial swindle began to fall apart as his purchasers took cash out sooner than he may bring in recent cash. These current purchasers often will even reinvest their very own funds back into the funding opportunity (scheme) on account of their excitement and joy of receiving such high returns on a constant foundation. New investors are drawn in as a result of this early success, and their funds are utilized to repay the unique investors, so perpetuating the cycle. Issues with paperwork. Account statement errors could also be a sign that funds should not being invested as promised. This is true arbitrage - having a market to purchase one thing for lower than you might be sure to be able to sell it for on another market. By not having an independent auditor study the company’s papers, Madoff was breaking the regulation. On Wednesday, Bernie Madoff died in government jail, as reported by a report from the Associated Press. Banks and fintech firms extract over $one hundred billion per year in transaction fees related to payments, serving as custodians and managers for consumer assets, and supplying liquidity as market makers between buyers and sellers. An analogous commentary applies to the allegedly revolutionary (and associated) blockchain technology, which has but to be adopted on a widespread foundation anyplace. Many of those investors are in a position to do their very own due diligence-evaluating a project’s staff, inspecting demo versions of their software, or scrutinizing their blockchain after launch. Madoff was an actual business visionary - the pc trading program created by the investment advisor and his sibling, Peter - was embraced by the (National Association of Securities Dealers Automated Quotations) NASDAQ trading commerce and established the framework for a big a part of the digital trading frameworks which can be atypical now. The size of the offenses was so important that even as we speak, only a few of Madoff’s victims will not be quite in a position to recuperate from their losses. Estimates of losses ranged from $50 billion to $65 billion, yet specialists observed that discovering the missing property could also be unattainable.

By not having an independent auditor study the company’s papers, Madoff was breaking the regulation. On Wednesday, Bernie Madoff died in government jail, as reported by a report from the Associated Press. Banks and fintech firms extract over $one hundred billion per year in transaction fees related to payments, serving as custodians and managers for consumer assets, and supplying liquidity as market makers between buyers and sellers. An analogous commentary applies to the allegedly revolutionary (and associated) blockchain technology, which has but to be adopted on a widespread foundation anyplace. Many of those investors are in a position to do their very own due diligence-evaluating a project’s staff, inspecting demo versions of their software, or scrutinizing their blockchain after launch. Madoff was an actual business visionary - the pc trading program created by the investment advisor and his sibling, Peter - was embraced by the (National Association of Securities Dealers Automated Quotations) NASDAQ trading commerce and established the framework for a big a part of the digital trading frameworks which can be atypical now. The size of the offenses was so important that even as we speak, only a few of Madoff’s victims will not be quite in a position to recuperate from their losses. Estimates of losses ranged from $50 billion to $65 billion, yet specialists observed that discovering the missing property could also be unattainable. The disgraced financier Bernie Madoff, who was convicted for working a Ponzi scheme that was unprecedented in its scale, died in prison on the age of 82, the US Federal Bureau of Prisons introduced on Wednesday. Financial reporter Diana Henriques, who wrote a e book in regards to the case, described Madoff's scheme in a 2011 Fresh Air interview as exploiting not traders' greed, but their concern. And when the investors began calling, Peter allegedly instructed Marino to write down them checks. In response to a 2019 article within the Aspen Daily News, Overton’s legal professional Peter Thomas wrote that his shopper was introduced to Peter in 2012 when ForU Holdings was doing business as Capsalus. Bernard Madoff's former defense legal professional, Ira Lee Sorkin, on Wednesday known as his loss of life the fruits of "an ideal tragedy, and there are no winners." Sorkin negotiated Madoff's 2009 guilty plea and represented him via his sentencing that 12 months, and has remained in contact with his former shopper. Despite not being conscious of the Ponzi scheme, stated Campbell, Madoff’s family had been complicit in his lies - specifically Madoff’s misrepresentation of investments, which Campbell referred to as illegitimate and in opposition to protocol. “When I called after the first three months, he advised me that the corporate had decided to situation dividends every six months because it was simpler and loads much less paperwork,” she said.

The disgraced financier Bernie Madoff, who was convicted for working a Ponzi scheme that was unprecedented in its scale, died in prison on the age of 82, the US Federal Bureau of Prisons introduced on Wednesday. Financial reporter Diana Henriques, who wrote a e book in regards to the case, described Madoff's scheme in a 2011 Fresh Air interview as exploiting not traders' greed, but their concern. And when the investors began calling, Peter allegedly instructed Marino to write down them checks. In response to a 2019 article within the Aspen Daily News, Overton’s legal professional Peter Thomas wrote that his shopper was introduced to Peter in 2012 when ForU Holdings was doing business as Capsalus. Bernard Madoff's former defense legal professional, Ira Lee Sorkin, on Wednesday known as his loss of life the fruits of "an ideal tragedy, and there are no winners." Sorkin negotiated Madoff's 2009 guilty plea and represented him via his sentencing that 12 months, and has remained in contact with his former shopper. Despite not being conscious of the Ponzi scheme, stated Campbell, Madoff’s family had been complicit in his lies - specifically Madoff’s misrepresentation of investments, which Campbell referred to as illegitimate and in opposition to protocol. “When I called after the first three months, he advised me that the corporate had decided to situation dividends every six months because it was simpler and loads much less paperwork,” she said. “When it was time to re-up our insurance coverage, John instructed me to decrease the variety of patients seen every day, to lower the premium,” she alleges. In line with her, Peter stated the one time they make an exception is when somebody has most cancers. “Clinics that see 20 patients a day make first rate cash, so I knew that 50 a day must mean that they are doing issues proper, and this investment would be a no-brainer,” she said. Because Alfonso labored in health care, she knew that the 50 patients a day Peter claimed the clinic was seeing would make it a very worthwhile funding. Shawn E. Good worked for Morgan Stanley, which terminated his employment in February for reportedly refusing to cooperate with an internal investigation. She was employed by Peter in 2017. Said she had labored tirelessly to build the business. Intrigued, Andersen said he wanted to know more, and after a number of months Peter told him he had an important investment.

“When it was time to re-up our insurance coverage, John instructed me to decrease the variety of patients seen every day, to lower the premium,” she alleges. In line with her, Peter stated the one time they make an exception is when somebody has most cancers. “Clinics that see 20 patients a day make first rate cash, so I knew that 50 a day must mean that they are doing issues proper, and this investment would be a no-brainer,” she said. Because Alfonso labored in health care, she knew that the 50 patients a day Peter claimed the clinic was seeing would make it a very worthwhile funding. Shawn E. Good worked for Morgan Stanley, which terminated his employment in February for reportedly refusing to cooperate with an internal investigation. She was employed by Peter in 2017. Said she had labored tirelessly to build the business. Intrigued, Andersen said he wanted to know more, and after a number of months Peter told him he had an important investment.

Ponzi scheme traders are unaware of the fraudulent practices and promised quick and easy returns by scammers. Ponzi schemes are a relatively common means for scammers to get one over on investors, and once they occur, the associated fee is often tremendous. When scams occur, unsuspecting buyers are sometimes caught off guard. It was true of the fraud committed almost a century ago by Charles Ponzi, an Italian immigrant in Boston who cheated traders out of $20 million by convincing them that they might make a bundle by shopping for an obscure type of postal order whose worth differed from nation to country and redeeming it for a profit in the United States. That is comparable to a pyramid scheme in that both are dependent on the use of latest investors’ monies to pay off the earlier backers who have contributed to this system. This further cash is utilized to pay the returns resulting from the unique buyers, which is denoted as a profit from a valid transaction. For both fraudulent schemes, the underlying assumption is that the brand new investors’ monies might be used to reimburse the original traders. He can even face a restitution hearing in the coming months.

Ponzi scheme traders are unaware of the fraudulent practices and promised quick and easy returns by scammers. Ponzi schemes are a relatively common means for scammers to get one over on investors, and once they occur, the associated fee is often tremendous. When scams occur, unsuspecting buyers are sometimes caught off guard. It was true of the fraud committed almost a century ago by Charles Ponzi, an Italian immigrant in Boston who cheated traders out of $20 million by convincing them that they might make a bundle by shopping for an obscure type of postal order whose worth differed from nation to country and redeeming it for a profit in the United States. That is comparable to a pyramid scheme in that both are dependent on the use of latest investors’ monies to pay off the earlier backers who have contributed to this system. This further cash is utilized to pay the returns resulting from the unique buyers, which is denoted as a profit from a valid transaction. For both fraudulent schemes, the underlying assumption is that the brand new investors’ monies might be used to reimburse the original traders. He can even face a restitution hearing in the coming months. After doing just a little background analysis, finding that both Capsalus and ForU violated SEC rules and rules, she first filed with them. Last year, Madoff's lawyer filed a movement begging the court for forgiveness in the type of an early release, reporting that his shopper was terminally ailing with kidney disease. That woman instructed the court docket she’s still caring for a 46-12 months-outdated particular needs daughter and didn’t have the money to spare. No Court of Law may give verdict in favor of ponzi schemes, quite they ought to be pressured upon to wind up their businesses and/or now allowed to thrive upon their unlawful enterprise ruining the widespread individuals to pay their value for lust and greed ,lured by astronomical price of return supplied by so called ponzi scheme operators. While there was some actual cash to be made on these coupons, Ponzi did pay traders his promised returns by attracting an increasing number of further investors and utilizing their funds to pay earlier buyers. While many traders are prone to lose cash on their EminiFX investments, the FBI complaint said certain traders successfully withdrew funds from the platform.

After doing just a little background analysis, finding that both Capsalus and ForU violated SEC rules and rules, she first filed with them. Last year, Madoff's lawyer filed a movement begging the court for forgiveness in the type of an early release, reporting that his shopper was terminally ailing with kidney disease. That woman instructed the court docket she’s still caring for a 46-12 months-outdated particular needs daughter and didn’t have the money to spare. No Court of Law may give verdict in favor of ponzi schemes, quite they ought to be pressured upon to wind up their businesses and/or now allowed to thrive upon their unlawful enterprise ruining the widespread individuals to pay their value for lust and greed ,lured by astronomical price of return supplied by so called ponzi scheme operators. While there was some actual cash to be made on these coupons, Ponzi did pay traders his promised returns by attracting an increasing number of further investors and utilizing their funds to pay earlier buyers. While many traders are prone to lose cash on their EminiFX investments, the FBI complaint said certain traders successfully withdrew funds from the platform. Potential new prospects clamored for Madoff to speculate their cash. That scandal is the topic of a new ebook, “Madoff Talks: Uncovering the Untold Story Behind essentially the most Notorious Ponzi Scheme in History,” by nationally syndicated US enterprise radio host Jim Campbell, who gained rare access to Madoff and his household. Another pink flag that was ignored on this story was that although Ponzi was giving such amazing returns on his investments, he by no means once invested his own money into the funding. He was known for committing monetary crimes as he conned folks into giving him hundreds of thousands of dollars as “investment” after which paid them back with his future investors’ cash. He emigrated to Canada after which to the United States, where extra petty crimes led to short jail sentences. The lesson to be discovered here is that there is no manner an individual or company can offer such high returns in such a short period of time doing something legal. Charles Ponzi wasn’t the primary individual to drag a “Ponzi Scheme,” and he won’t be the last both. Charles Ponzi’s career is listed within the Biographical Almanac as “swindler.” Ponzi’s name is immortal as a result of he had the genius to turn a respectable business venture into a very profitable crime.

Potential new prospects clamored for Madoff to speculate their cash. That scandal is the topic of a new ebook, “Madoff Talks: Uncovering the Untold Story Behind essentially the most Notorious Ponzi Scheme in History,” by nationally syndicated US enterprise radio host Jim Campbell, who gained rare access to Madoff and his household. Another pink flag that was ignored on this story was that although Ponzi was giving such amazing returns on his investments, he by no means once invested his own money into the funding. He was known for committing monetary crimes as he conned folks into giving him hundreds of thousands of dollars as “investment” after which paid them back with his future investors’ cash. He emigrated to Canada after which to the United States, where extra petty crimes led to short jail sentences. The lesson to be discovered here is that there is no manner an individual or company can offer such high returns in such a short period of time doing something legal. Charles Ponzi wasn’t the primary individual to drag a “Ponzi Scheme,” and he won’t be the last both. Charles Ponzi’s career is listed within the Biographical Almanac as “swindler.” Ponzi’s name is immortal as a result of he had the genius to turn a respectable business venture into a very profitable crime.